Analysis of Federal Reserve Economic Data (FRED)

Image credit: [Unsplash]

Image credit: [Unsplash]FRED (Federal Reserve Economic Data) is a large, free database maintained by the Federal Reserve Bank of St. Louis. Widely used by economists, analysts, researchers, and students for economic analysis, forecasting, and policy research.

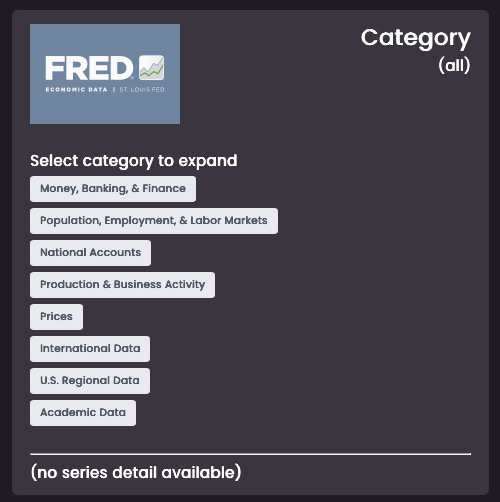

Access to this data is provided by an external agent, which uses the FRED API obtain access to all these data series.

The agent consists of 2 node types: One to provide a mechanism to drill down through the data collections, and the second to extract the data series.

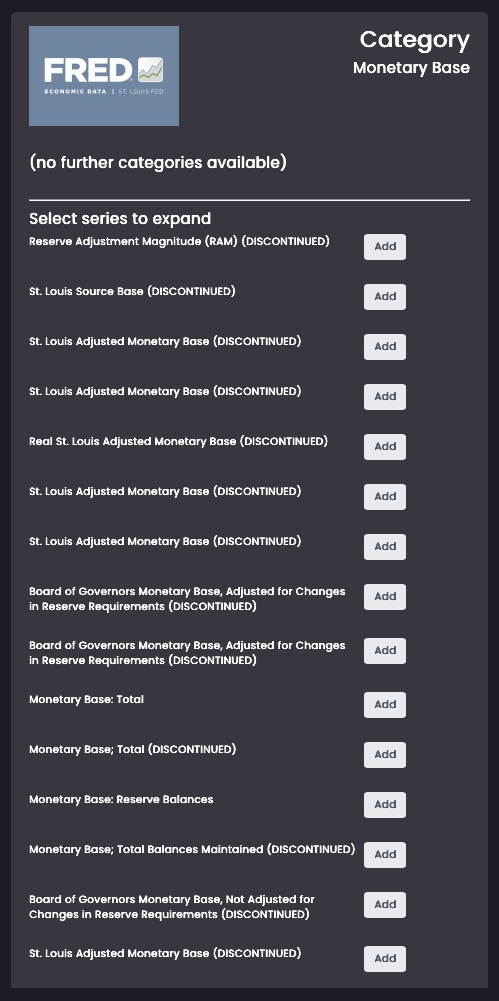

Obtain series detail

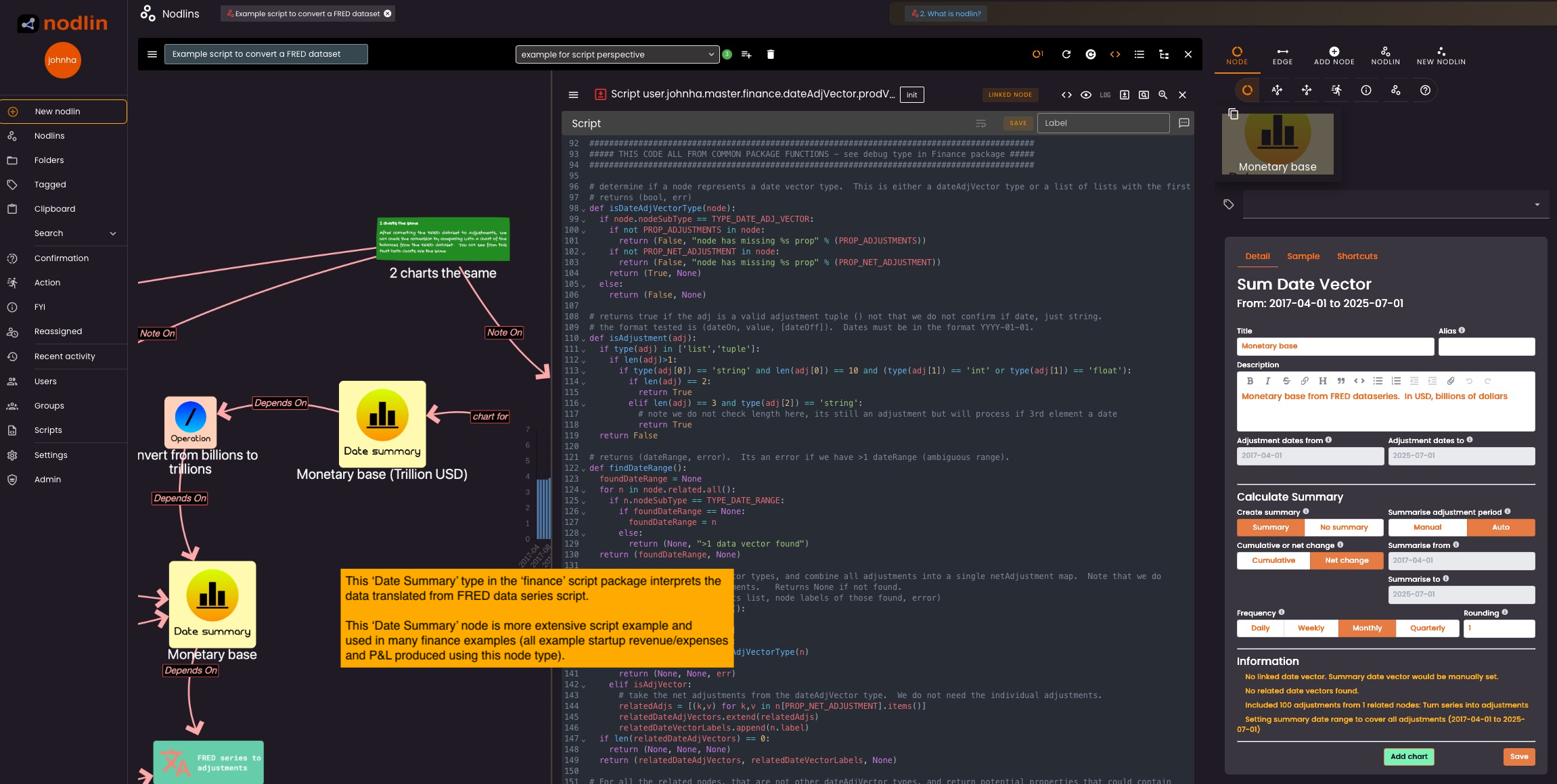

In the following example we have selected the US monetary base data series and applied the date criteria on which we want to review.

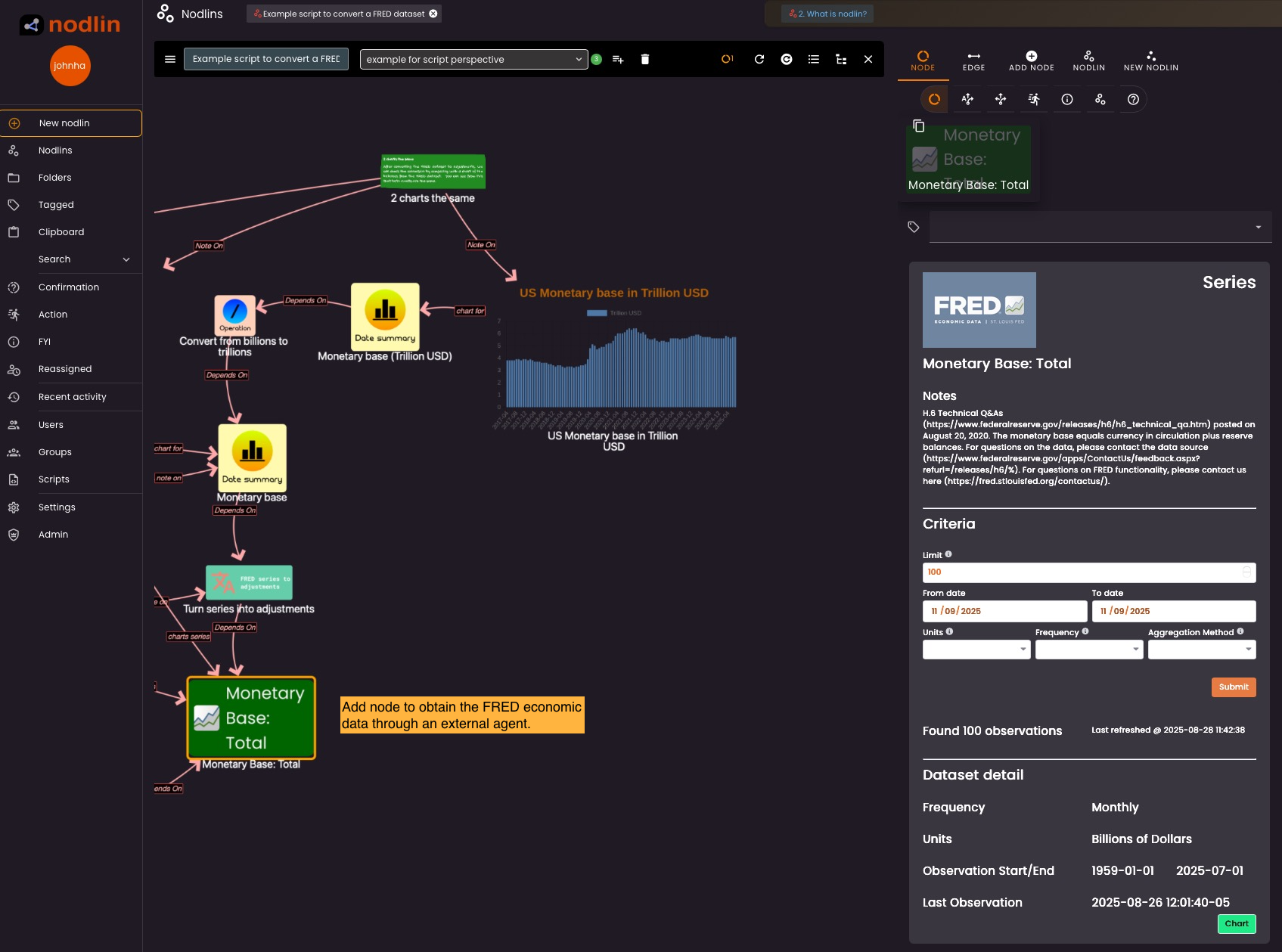

Apply local script to the data series

In this example we want to convert the data series into a format for the finance script package. We therefore have a small internal script, and named for re-use by other users.

Detail converted for the finance Date summary node type

The finance Date summary node type is a core node type used in the finance package (more comphrehensive script example). It provides many features.

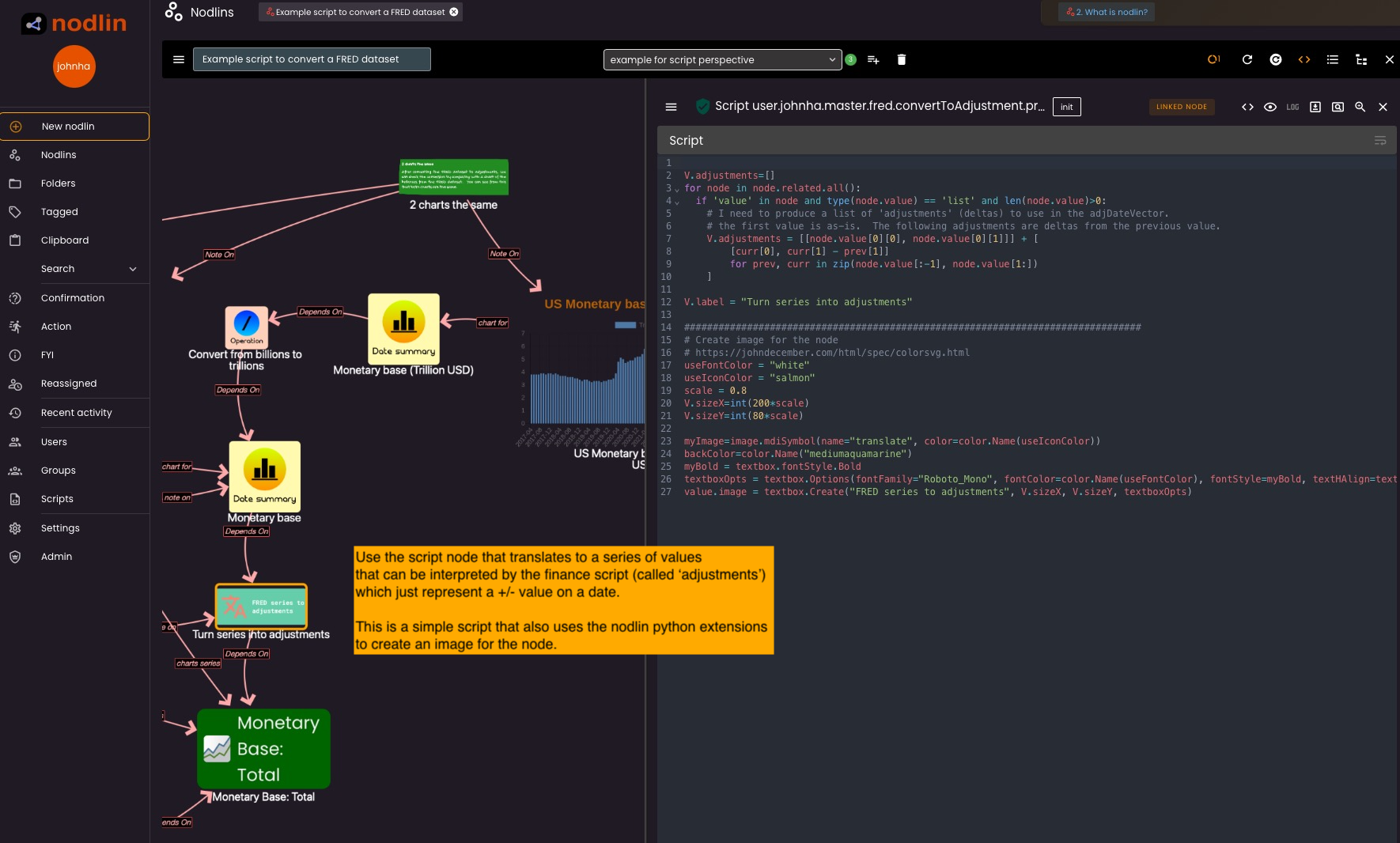

Convert to billion USD

We apply an operation on the data set to convert to billion USD. We pass through a simple operation node type available in the finance package, that operates on Date Summary.

Present summary in excalidraw

The last step is to present the analysis using the excalidraw view, with comments, title and summary detail.